Acquiring Litecoin involves more than just its market price. A variety of fees can affect the total cost of your investment. For beginners, understanding these charges is a critical step toward making informed financial decisions. This guide breaks down the common Litecoin purchase fees and explains the cost structures you are likely to encounter.

The Multilayered Cost of Acquiring Litecoin

The advertised exchange rate for Litecoin rarely reflects the final amount you will pay. Your actual acquisition cost is influenced by a multilayered fee structure. Recognizing these different components allows for better cost management and helps you avoid surprises.

Exchange and Platform Fees

The most fundamental cost is the exchange or platform fee. This is the service charge for processing your transaction. It is typically calculated as a percentage of your total purchase amount, generally ranging from 0.1% to 1.5%. This fee is applied to all purchase methods on the platform.

Payment Method Premiums

The way you fund your purchase significantly affects the overall cost. Using a credit or debit card provides speed and convenience but often incurs a premium. These payment fees can range from 1.5% to over 5%, depending on the platform. In contrast, using a bank transfer may be a lower-cost option but can result in longer settlement times.

The Spread: A Hidden Cost

A less obvious cost is the “spread.” This is the difference between the buying price and the selling price of an asset at the same moment. On some platforms, especially broker services, the price at which you buy Litecoin may be slightly higher than the actual market rate. This hidden difference, or spread, can range from 0.2% to 3% and contributes to your total cost.

Network Transaction Fees

Network fees are not associated with buying Litecoin on an exchange but are applied when you withdraw it to an external wallet. These fees are paid to the network miners who validate the transaction. For Litecoin, this is usually a small, flat fee, such as 0.001 LTC. You can often minimize this cost by batching withdrawals during periods of low network congestion.

Card-Based Purchases: Convenience vs. Cost

For many new investors, buying Litecoin with a credit or debit card is the most direct entry point. However, this convenience comes with trade-offs. It is important to understand the fee structures associated with card payments to assess the true cost.

Comparing Card Fees

Platforms often charge different rates for credit and debit cards. The average fees can vary significantly based on the type of platform you use.

- Credit Cards: Fees often range from 3.99% to 5.9%. Be aware that some credit card issuers may treat a cryptocurrency purchase as a cash advance, which can trigger additional fees and higher interest rates.

- Debit Cards: Fees are typically slightly lower, averaging between 1.5% and 4.9%.

When you use a debit card, always check if the provider charges both a percentage-based fee and a flat fee. These combined charges can substantially increase the cost of your transaction, turning a seemingly small fee into a significant expense.

Strategizing Your Litecoin Acquisition

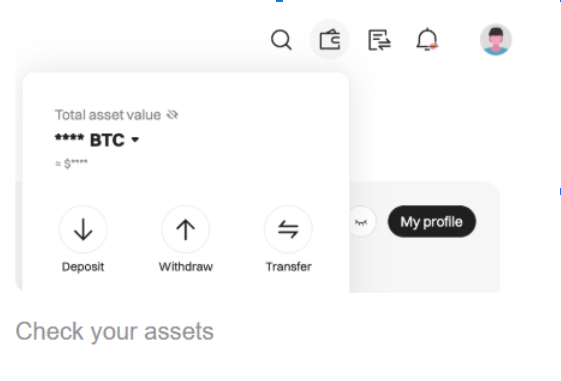

Beyond understanding fees, a strategic approach to purchasing can enhance efficiency. This begins with selecting the right channel for your needs and understanding the process. While exchanges are common, various platforms offer different benefits regarding fees, verification, and payment options. The process generally involves creating an account, connecting a funding source, and then executing the purchase.

A disciplined acquisition strategy, such as dollar-cost averaging (DCA), can also be beneficial. This involves investing equal amounts at regular intervals, which can help mitigate the impact of market volatility. For those ready to begin, a step-by-step guide on how to buy Litecoin can simplify the process, from creating an account to completing your first purchase securely.

Conclusion: Looking Beyond the Advertised Rate

Understanding the true cost of buying Litecoin is essential for any investor. The final price is a combination of the asset’s market value plus various fees, including platform charges, payment method premiums, and potential spreads. The convenience of instant purchases via credit or debit card often comes at a higher cost compared to slower methods like bank transfers.

By carefully examining the fee schedules of different platforms and understanding how each component contributes to the total cost, you can make more strategic decisions. This knowledge empowers you to choose a purchasing method and platform that aligns with your financial goals, ensuring a more transparent and cost-effective entry into the world of Litecoin.